Masters of Business Administration- MBA Semester 2

MB0045 –Financial Management - 4 Credits

(Book ID: B1134)

Assignment Set- 1 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions.

a) At what price would you buy the bond if the prevailing interest rate is 12% pa on investments of similar risk?

b) What is the YTM of the bond if the prevailing price is same as calculated in a) above.

c) What is the current yield of the bond at the given price?

d) If the coupon rate is paid semi-annually, at what price would you buy the bond at the 12% pa prevailing interest rate?

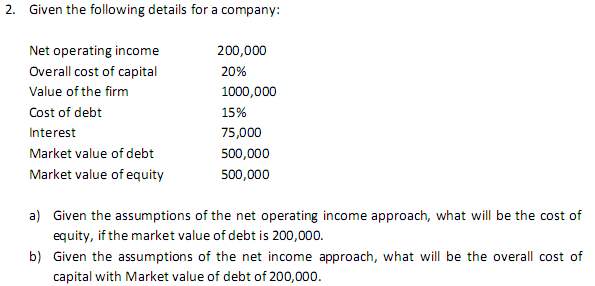

2. Given the following details for a company:

a) Given the assumptions of the net operating income approach, what will be the cost of equity, if the market value of debt is 200,000.

b) Given the assumptions of the net income approach, what will be the overall cost of capital with Market value of debt of 200,000.

3. Given the following projects , rank them on the basis of NPV, MIRR and Payback period if the

cost of capital is 10% pa.

4. Given the following information, calculate Degree of operating leverage, Degree of Financial

leverage, Degree of total leverage.

5. Explain the following concepts :

a) Operating cycle

b) Total inventory cost

c) Price earnings ratio

d) Financial risk

6. Explain the Net operating income approach to capital structure theories.

Home

Home